تُعد مكافأة FLR، أو rFLR، جزءًا أساسيًا من نظام Flare البيئي المتنامي الذي يكافئ ويحفز المشاركة.

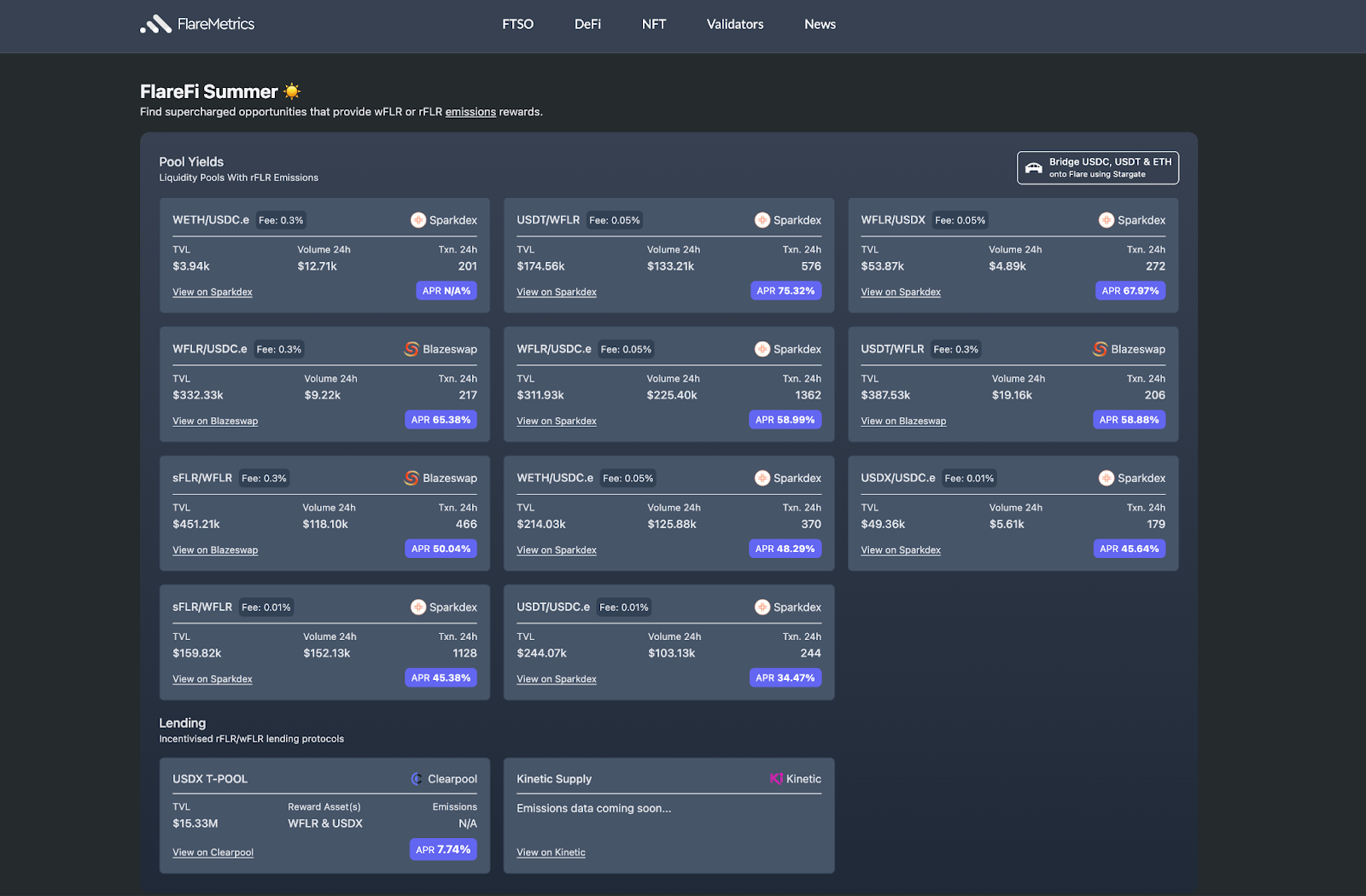

على وجه التحديد، تم تطوير F لبناء سيولة عميقة لأصول رقمية متعددة على تطبيقات DeFi dapps التي تعمل على Flare. لتتبع استراتيجيات العائدات المختلفة المتاحة لمستخدمي Flare، تعد لوحة معلومات FlareMetrics أداة رئيسية للتأكد من حصولك على أحدث المعلومات حول ما يمكنك القيام به لكسب المكافآت والمبلغ الذي يمكنك تحصيله.

كيف يعمل rFLR؟

يتم توزيع rFLR شهريًا من قبل لجنة انبعاثات Flare Emissions من أجل زيادة السيولة في نظام Flare's DeFi البيئي وتحفيز المشاركة على Flare. يتم تخصيص المكافآت شهريًا من قبل لجنة انبعاثات Flare Emissions Committee إلى التطبيقات الرقمية المشاركة التي تقوم بعد ذلك بتوزيع المكافآت على المستخدمين الذين يشاركون في أنشطتهم المحفزة على السلسلة. سيحصل المستخدمون المؤهلون على مكافآت rFLR شهريًا، والتي يمكن المطالبة بها مباشرةً من خلال بوابة Flare. ستستحق مكافآت rFLR على مدار 12 شهرًا.

ولكن ما هي التطبيقات التي يمكن استخدامها لاستكشاف وكسب مكافآت rFLR؟

كسب مكافآت rFLR

نظرًا لأن الانبعاثات تُستخدم كحافز لتعزيز نشاط DeFi على Flare، فإن معايير اختيار التطبيقات المؤهلة تعطي الأولوية لبروتوكولات DeFi. لتتبع مجمعات السيولة وبروتوكولات الإقراض التي يتم تحفيزها من خلال برنامج Flare DeFi Emission Program، يرجى الرجوع إلى صفحة FlareMetrics. توفر لوحة التحكم أيضًا تقديرات APY للبروتوكولات المؤهلة، بالإضافة إلى TVL وحجم وعدد المعاملات.

فيما يلي بعض بروتوكولات DeFi الشائعة على Flare التي يتم تحفيزها باستخدام rFLR:

- BlazeSwap: بورصة ديناميكية فعالة على غرار Uniswap V2 تقدم مجموعة واسعة من مجمعات السيولة.

- Kinetic: منصة اقتراض وإقراض تتيح للمستخدمين الاستفادة من أصولهم الموردة (بما في ذلك الأصول المالية) في استراتيجيات مالية مختلفة

- SparkDEX: بورصة SparkDEX: بورصة ديناميكية على غرار Uniswap V3 مع مجمعات سيولة مركزة تتضمن عملات مستقرة و wFLR و sFLR.

- Sceptre: منصة رهان سائل تسمح للمستخدمين بالمراهنة على الرهان السائل (wFLR) مقابل الرهان السائل، وهو نسخة سائلة من الرهان السائل من FLR.

هذه ليست سوى عدد قليل من تطبيقات DeFi المباشرة المؤهلة للانبعاثات. ستتم إضافة المزيد من البروتوكولات إلى قائمة التطبيقات المؤهلة بمرور الوقت. سيتم توسيع نطاق الانبعاثات الشهرية أيضًا مع إضافة المزيد من التطبيقات إلى برنامج Flare DeFi Emission Program. ترقبوا أن تقوم Enosys و XDFi و RainDEX بتوزيع مخصصات المكافآت الخاصة بها في الأشهر المقبلة.

لاحظ أنه يمكن كسب المكافآت المتراكمة في نفس الوقت مع FlareDrops الشهرية. تُستحق المكافآت المتراكمة خطيًا على مدار 12 شهرًا، مع إمكانية المطالبة ب 1/12 منها وسحبها شهريًا على هيئة مكافآت متراكمة من WFLR من البوابة. يترتب على السحب المبكر للمكافآت غير المستثمرة غرامة بنسبة 50%. للحصول على أقصى عوائد، انتظر الاستحقاق الكامل.

rFLR contract address: 0x26d460c3Cf931Fb2014FA436a49e3Af08619810e

كيف يتم توزيع rFLR؟

rFLR-eligible protocols set their own criteria for user rFLR reward distributions. The Emissions Committee favors strategies that incentivize participation. The rewards are then distributed by the dapps.

ماذا عن أي من حقوق الملكية الفكرية غير المطالب بها أو غير الموزعة؟

- Unclaimed rFLR by users: Any unclaimed monthly rFLR distributions may stay open for a certain amount of time, or these funds could be reallocated to future programs or even burned (e.g. 1 year after the program concludes).

- Undistributed rFLR by projects: Protocols have 30 days to distribute rFLR rewards. If the protocol does not distribute to its users within this window of time, the Committee reserves the right to reclaim rFLR for future reallocation or burn.

Note: The Emissions Committee has discretion as to how the rFLR are allocated to different ecosystem dapps, with priority on growing onchain liquidity in preparation for the FAssets launch.

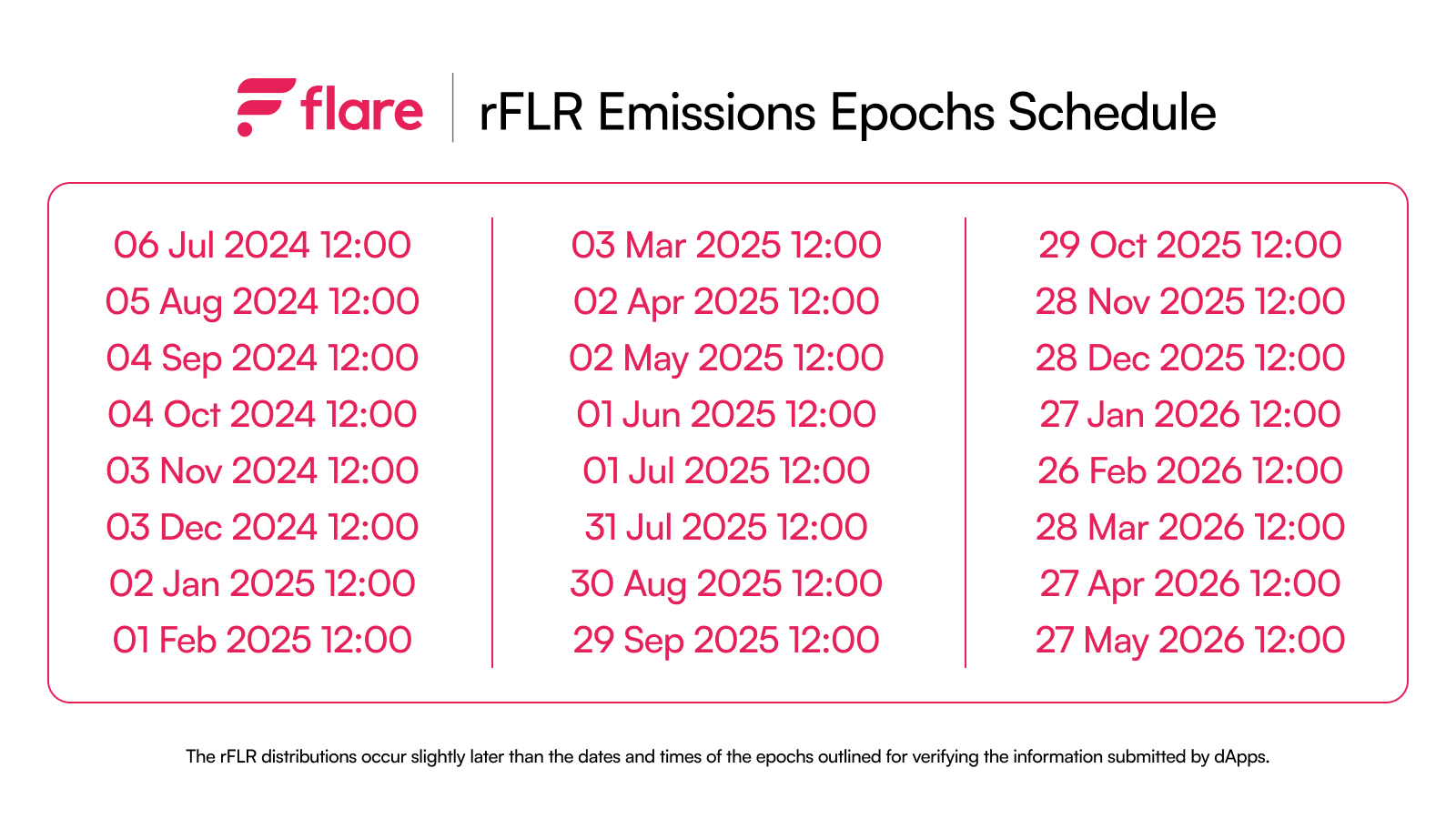

What is the distribution schedule for rFLR?

Below, is a table outlining the rFLR emissions epochs schedule:

Note: As the emissions participation for each dapp is calculated according to each dapp’s own parameters, with time and volume-based metrics factored in, the amount of time it takes to verify fair allocations can vary. This means distributions may take place later than the dates and times outlined in the schedule outlined.

كيف يتناسب rFLR مع نظام Flare البيئي الأكبر؟

تتجاوز أهمية rFLR مكافأة المشاركين - فهي جزء لا يتجزأ من استراتيجية Flare الأكبر لجذب سيولة أعمق وزيادة نشاط DeFi بشكل عام. هذا يدعم بشكل مباشر إطلاق FAsset من خلال تحفيز تكامل الرموز المميزة للعقود غير الذكية مثل BTC و XRP. كما يعني أيضًا المزيد من السيولة عبر السلاسل وإمكانية التشغيل البيني السلس بين Flare والسلاسل الأخرى.

من خلال الترويج لاستخدام استراتيجيات DeFi مثل الإقراض أو الاقتراض على Flare، وضعت انبعاثات rFLR أساسًا قويًا لإطلاق الأصول المالية على الشبكة الرئيسية.

تذكّر الرجوع إلى لوحة معلومات FlareMetrics لزيادة مكافآت معدل الانبعاثات إلى أقصى حد. للاطلاع على أمثلة لاستراتيجيات العائدات والمزيد من المعلومات عن الانبعاثات، يُرجى الرجوع إلى مقال الانبعاثات.