Why native BTC cannot be sent to other blockchains?

Blockchains are like islands, each with distinct priorities reflected in their technical and social structures.

Bitcoin, the original cryptocurrency, initiated the movement toward a decentralized future. It prioritizes security and decentralization over speed and programmability, evident in its design:

Limited Composability:

Bitcoin script is intentionally simple to maintain security and minimise the attack surface. This simplicity prevents excessive resource consumption, supporting decentralization and security. Unlike Ethereum, which supports complex smart contracts and decentralized applications, Bitcoin is designed primarily as a digital currency and not for cross-blockchain operations.

Transaction Speed and Scalability:

Bitcoin has a block time of about 10 minutes, limiting transaction speed and scalability. This slower block time is a trade-off for maintaining security and decentralization. Scaling has been difficult, with consensus on changes hard to achieve, as seen during the “Block Size Wars.”

In conclusion:

- Bitcoin’s architecture does not natively support interoperability with other blockchains, limiting its application capabilities.

- BTC cannot be moved across chains, as the BTC are confined to the Bitcoin blockchain without native bridging solutions to other composable chains.

Ways of putting BTC to work: Bridging

Bitcoin is often referred to as digital gold because of its limited supply of 21 million coins, currently valued at around $1.4 trillion. If we could unlock just 10% of this value for decentralized finance (DeFi) activities, like those on Ethereum, that would amount to about $140 billion, showing the untapped potential of Bitcoin in the DeFi space.

Recent developments like BitVM offer a way to create Turing-complete smart contracts on Bitcoin. BitVM attempts to provide a NAND gate structure on Bitcoin that allows for basic verification of proofs on Bitcoin. However, BitVM is currently in the conceptual and early development stages. NAND gates have been a clunky solution to trying to get Turing complete scripts on bitcoin.

Teams are leveraging BitVM to verify a ZK proof on Bitcoin optimistically, assuming correctness unless challenged. This approach could lead to Layer 2 solutions that look similar to Ethereum’s Layer 2 ecosystem. However, the practical implementation and scalability of these solutions are still being explored.

Other protocols, like the staking platform Babylon, aim to increase BTC’s utility and align with Bitcoin’s core principles. However, these solutions often require soft fork upgrades to the Bitcoin network, such as OP_CAT or OP_CTV, to operate trustlessly without relying on a covenant committee.

Bridging BTC to other chains unlocks opportunities such as using BTC as collateral in DeFi lending platforms, earning interest, and trading across decentralized exchanges (DEXs). There is considerable room for improving trust-minimized bridges for BTC.

Why is it difficult to build a trust-minimized bridge for BTC?

Building a trust-minimized BTC bridge involves significant challenges in balancing security, decentralization, and efficiency. Centralized solutions like Wrapped Bitcoin (WBTC) dominate the market but rely on custodians, introducing custodial risk and contradicting decentralization principles.

Trust-minimized bridges aim to reduce failure points using smart contracts or a network of participants, but they often require complex setups involving cryptographic proofs or multi-signature schemes. These setups are technically complex, and demand high resilience and coordination, which are challenging in a decentralized environment.

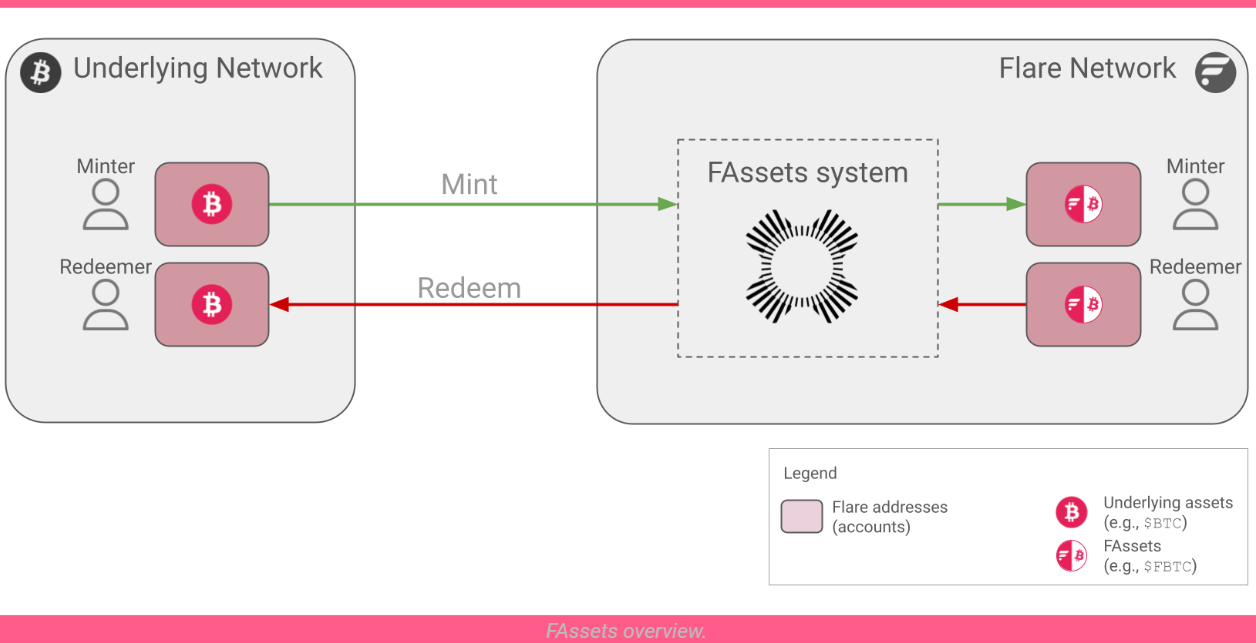

FAssets addresses some of these challenges by implementing:

- Overcollateralization: FAssets are overcollateralized by multiple assets, including BTC, stablecoins, ETH, and FLR, and are locked in smart contracts that ensure the minted FAssets can always be redeemed for the underlying assets they represent or compensated by collateral, providing verifiable economic security.

- Flare Time Series Oracle (FTSO): Flare’s enshrined oracle FTSO provides accurate and decentralized price feeds and collateral ratio calculations.

- Flare Data Connector (FDC): FDC is another of Flare’s enshrined oracles, using independent attestation providers to read and verify the state of other blockchains. It confirms minters’ payments on connected chains, such as the Bitcoin network, and brings payment data onto Flare. Once confirmed, the minting process can be executed, sending FAssets (e.g., FBTC) to the minter’s account.

This is the summary of the minting process:

During the Open Beta starting in early June, the FAssets system demonstrated resilience by continuing to operate despite multiple network outages where the XRP testnet stopped producing blocks for over 12 hours. The system functioned as designed, allowing users attempting to redeem during this period to receive payments in testUSDC/T.

Additionally, FAssets proved its robustness against price fluctuations of the underlying asset, testXRP, triggered by an SEC announcement. This resilience is attributed to the system’s liquidation mechanism, which effectively manages significant price changes by ensuring that collateral remains sufficient to cover the value of the FAssets.

FAssets can play a pivotal role in making BTC a liquid asset within the Bitcoin DeFi ecosystem. By bridging BTC through FAssets, we enable it to be integrated into various DeFi protocols, enhancing liquidity and usability. Some of the possibilities:

- DeFi integration: Benefiting from Flare’s robust DeFi ecosystem, FAssets can easily be integrated into decentralized exchanges, lending protocols, and more. For the broader BitFi ecosystem, FAssets can be used as a settlement layer and a key element for a more comprehensive financial ecosystem for Bitcoin.

- Enhanced utility: By converting BTC into FAssets, users can leverage their holdings in a range of financial activities without having to sell or exchange their BTC, preserving their exposure to Bitcoin while benefiting from DeFi opportunities.

Through FAssets, Bitcoin can connect with other blockchain “islands,” unlocking its full potential to decentralize finance.

So, when?

The FAssets open beta, launched on June 4th, has successfully facilitated the bridging of 39 million TestXRP to Flare for 32,000 participants. The Ripple XRP Testnet reset on Monday 19th August, necessitating a pause in the FAssets Open Beta.

The relaunch of the FAssets Open Beta is approaching, with FBTC support on the roadmap. Here’s a glimpse:

- Wallet support: We’ve expanded wallet support for FBTC.

- Agent support: We are testing Agent’s vault with TestBTC.

- Minting and redeeming of FTestBTC will be available in the very near future.

Get ready for a new standard of decentralized wrapped BTC ☀️✅